Coordination of benefits (COB)

When employees have multiple insurance plans, you need to make sure the correct plans are making payments, this is referred to as coordination of benefits (COB![]() A provision for determining benefits when a member has more than one benefit plan.). COB policies create a framework for the two insurance companies to work together to coordinate benefits so they pay their fair share. COB decides which is the primary plan and which one is secondary. The primary plan pays its share of the costs first. Then, the secondary insurer pays up to 100% of the total cost of care, as long as it's covered under the plans. The plans won't pay more than 100% of the treatment cost.

A provision for determining benefits when a member has more than one benefit plan.). COB policies create a framework for the two insurance companies to work together to coordinate benefits so they pay their fair share. COB decides which is the primary plan and which one is secondary. The primary plan pays its share of the costs first. Then, the secondary insurer pays up to 100% of the total cost of care, as long as it's covered under the plans. The plans won't pay more than 100% of the treatment cost.

- A retiree has health insurance with a former employer and Medicare.

- An individual has health insurance through her spouse’s employer as well as her own employer.

- A dependent child has health insurance under both parents.

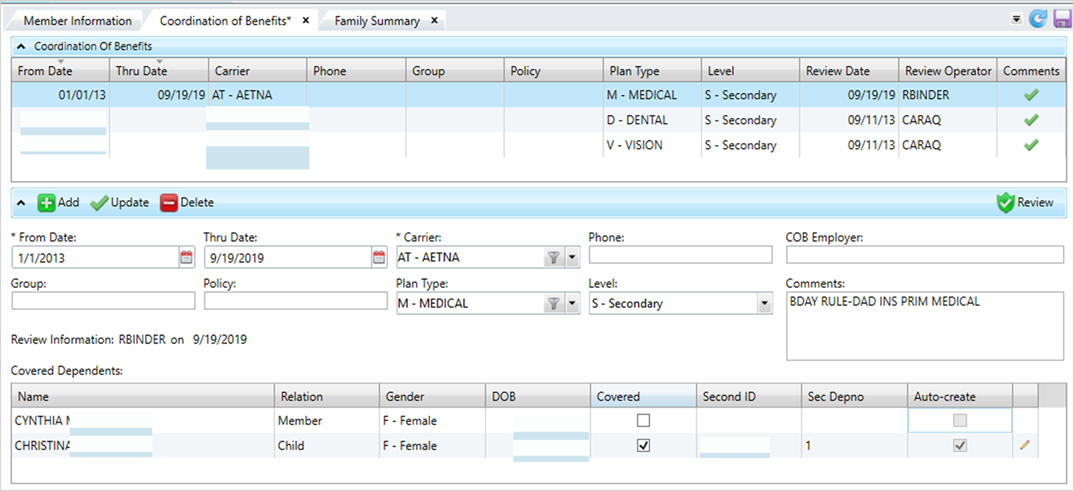

Use the COB menu to record and track Medicare and other insurance information to pay claims correctly. Access this function from the star menu during claims processing or claims entry, or from the Claims menu in either a member or dependent session.

The Coordination of Benefits table lists the available insurance coverages. Select a row in the table to see the insurance coverage details.

* indicates a required field

| Field | Description |

|---|---|

| From Date* | The date of the other insurance coverage is in effect. Click |

| Thru Date |

The termination date of the other insurance coverage. |

| Carrier* | The organization that issued the insurance policy. Select a carrier from the list. |

| Phone | The carrier's phone number. Enter any alphanumeric or non-alphanumeric characters. |

| COB Employer | The employer associated with the benefit plan offering. This is a free-form text field to show the employer, but there is no validation on spelling or verification the employer is in the system. This information won’t display anywhere else. |

| Comments | Additional information associated with the insurance coverage. Any comment text longer than 30 characters will wrap and show in the text box. |

| Group | The group or employer name. Enter any alphanumeric or non-alphanumeric characters. |

| Policy | The policy number for the healthcare coverage. Enter any alphanumeric or non-alphanumeric characters. |

| Plan Type | The claim benefit plan type (e.g. medical, dental or vision). |

| Level |

The insurance plan order to pay the claim. The primary health insurance is the plan that pays the claim first, as if it were the only source of health coverage. Then, the secondary insurance plan picks up the cost left over after the primary plan has paid the claim.

|

| Covered Dependents |

The table lists each member of the family.

Dual COB

|

| Review Information |

Text that shows and the date and the operator ID of the person who last reviewed (clicked |

Learn how to manage and process COB: